The Benefits of an External Audit

What exactly is an External Audit?

An external audit is performed by an independent auditor(s) with the aim of obtaining reasonable assurance and expressing an independent opinion on whether a company’s financial statements show a true and fair view (of its performance and position for the respective accounting period) and are free from material misstatements due to fraud or error.

It is crucial to note that a company’s management retains the primary responsibility for preparing the financial statements themselves and also preventing, detecting and/or correcting any misstatements during preparation.

How is an External Audit Relevant for you?

Legislation in Bangladesh stipulates that all companies in Bangladesh require an external audit of their financial statements to be performed for each financial year and specifies that they can only hire registered Chartered Accountants to perform these audits. The audit also needs to be performed within a specific timeframe following the end of each financial year.

Therefore, if you own or work for a business that is registered as a Limited Company in Bangladesh. Then, your financial statements will need to be audited as per law.

How exactly does an External Audit Work?

In order to truly understand how an external audit works, it is best to dive into its different stages:

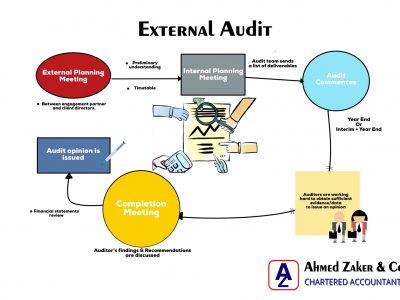

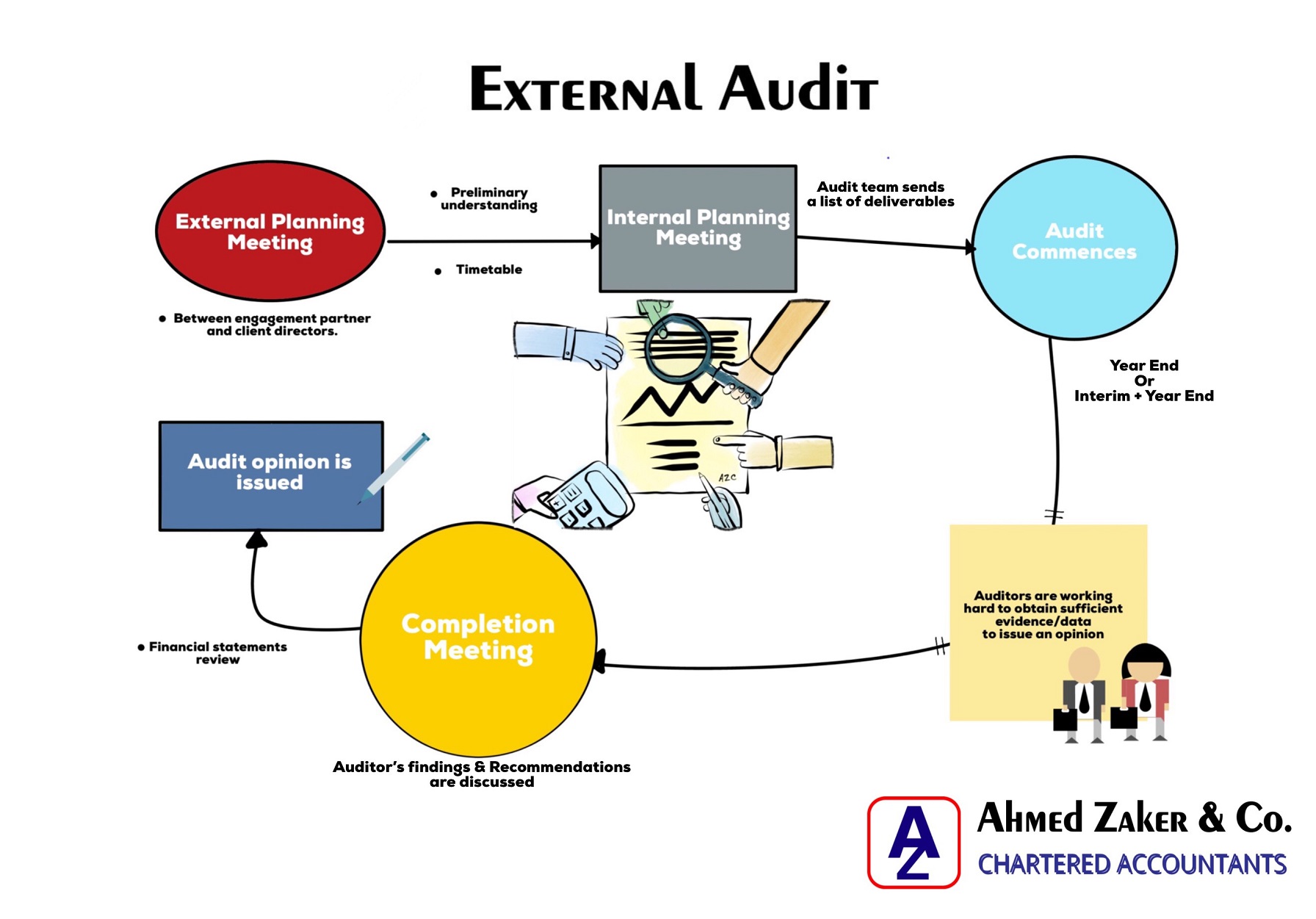

At the start of the audit, the auditors will look to have a planning meeting with the client in order to establish a preliminary understanding of their financial performance and position during the financial year that will undergo the audit.

This meeting will be attended by the Engagement Partner alongside a manager and senior members from the client entity, for instance, the Managing and Finance Director.

The Engagement Partner on an audit team is ultimately responsible for directing the audit and ensuring that it meets the standards expected. He is also the Responsible Individual for signing the report where auditors state their independent opinion following the audit.

During the meeting, the senior members of the audit team and the client decide on an appropriate timetable for the audit and a tentative date for the issue of the audit report.

The planning meeting with the client is followed by another internal planning meeting conducted by just the audit team itself. This is where they have a discussion of the key areas that they would like to focus on during the audit and the information that they would need to be able to carry out the necessary procedures.

Subsequently, a list of audit deliverables (i.e. information which is to be provided by the client) is then sent to the client. This is done prior to the audit commencing date, so the client can have time to prepare all the necessary information before the audit starts.

The audit team then comes to the client’s premises and starts the audit. An external audit often has two distinct stages:

-

An interim (or systems) audit where auditors test whether a client’s internal controls and processes that have been implemented within the business are effective in preventing, detecting or correcting material misstatements in the financial statements.

-

A year-end (or financial statements) audit where the auditors will work on the financial statements prepared by management. This is a more numbers-focused audit where auditors will focus the majority of their work on the underlying records behind the numbers on the financial statements. This is also usually the stage where auditors are in a good position to understand whether the company has complied with the appropriate and applicable accounting standards.

Depending on the nature of the business, an external audit may either only be a year-end audit or consist of both an interim and a year-end audit.

Once the audit is performed, the auditors will have a completion meeting with the client where they will have a discussion of their findings and any adjustments or recommendations that they would like to make to the client.

Following the discussions, the auditors will perform a final review of the financial statements the directors have agreed to sign off on to ensure consistency and issue their opinion on the financial statements in the form of an independent auditors’ report.

How can you benefit from an External Audit?

It’s normal to feel that an audit is a costly and disruptive process that legislation has forced upon you. It is also not unnatural to feel a bit annoyed or uneasy with the auditors when they are on site and reviewing your company’s financial records.

However, there are also a several benefits to reap from having an independent team of accountants reviewing your financial statements, its underlying records and the processes in place to prepare them:

Auditors can help you in identifying the weak points in your accounting system and suggest improvements.

An audit assures the board of directors who are not directly involved in the accounting functions on a day-to-day basis that their business is running in accordance with the information they are receiving, and helps reduce the chances of fraud and poor accounting.

An audit will improve the credibility and reliability of the figures being submitted to prospective investors or lenders as well as third parties, such as taxation authorities. Additionally, it can also help you in understanding how well your company is doing and which is key in planning the strategic direction of your company.

Auditors can often be a good, independent source for advice regarding the industry and the latest accounting standards and how they can affect your business. Additionally, they may provide insight that allows your business to set realistic forecasts about their revenue, profits, losses and tax and earn higher margins in the long run.

What if your business is not a Limited Company?

It’s not unusual to see unincorporated businesses such as sole traders or partnerships decide on having an external audit despite there being no regulatory requirement. Due to the aforementioned benefits, such business owners often suggest that the audit fee spent is a good investment.